Who should pay council tax

If you are over 18, and rent or own a property in Newham, then you will usually need to pay Council Tax.

If you live alone, you will be responsible to pay the Council Tax. If more than one person lives at the property, we will use a system called ‘the hierarchy of liability’ to establish who is responsible for paying the council tax.

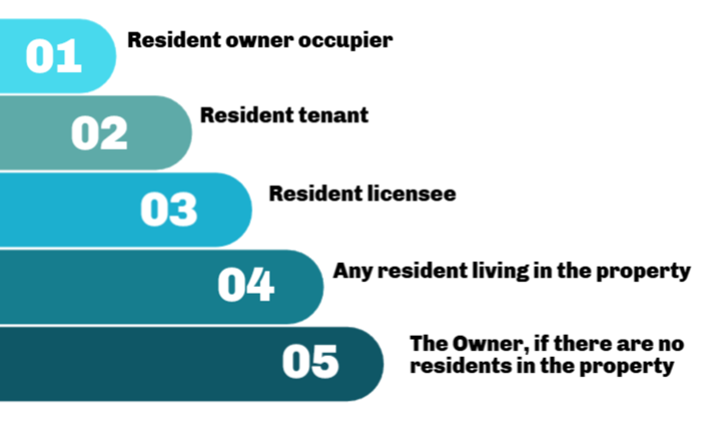

Hierarchy of liability:

Key points:

- The person nearest to the top of the hierarchy is the person responsible for paying the Council Tax.

- Two people at the same point in the hierarchy have the same responsibility to pay.

- Spouses and partners who live together are jointly responsible.

- If no one lives at the property, then the owner is responsible for the Council Tax.

When the owner should pay the Council Tax

The owner, rather than the occupier, is responsible for paying the Council Tax for:

- Unoccupied residential properties

- Houses in multiple occupation (HMO), e.g. Groups of bedsits which share washing and cooking facilities

- Properties occupied only by asylum seekers

- Properties used by religious communities

- Care and nursing homes and some hostels

- Property which is the sole or main home of someone the owner employs in domestic service

- Some second homes