Affordable workspace/markets/venue hire

Whether you're a new business looking for premises or an established company searching for a larger office space, the list below describes the range available for rent in Newham (It’s not exhaustive).

If no premises are available, continue checking on individual sites for availability.

|

Organisation |

Description |

|

All Council-owned commercial premises including retail, office and industrial places. |

|

|

Stratford |

|

|

18 commercial spaces that have been designed with every kind of business in mind. |

|

|

Stratford Workshops are made up of affordable 100 self-contained workshop units |

|

| Us & Co |

Workspace for freelancers, start-ups and established businesses, who needs a co-working desk, a part-time workspace or a full-time private office. There is also a wide range of meeting rooms, which can be booked by the hour, full-day or half-day. We have teamed up with Us&Co to bring you an exclusive 20% discount to hire your next meeting or event space and 10% on desk space. To secure your discount email us for more details. |

| Alice Billings House | 30 studio spaces, a gallery/project space and café, creating affordable studios for artists, as well as space and opportunities for the creative and wider community. |

| Divisible Space |

Located at Sugar House Island, a vibrant new neighbourhood situated a short walk from Queen Elizabeth Park. They have a mixture of co-working desks, private offices, self-contained, managed workspaces and event space. To get 12% off email us for more details. |

|

Royal Docks |

|

|

Stylist waterfront studios below the Silvertown flyover. Expressway is a community of 122 business suites and 39 maker units. We have teamed up with Expressway to offer you exclusive discount for desk space. Email us for more details. |

|

|

Royal Docks Centre for Sustainability |

The Centre provides local people, businesses and UEL students and graduates access to:

|

|

34 functional, pared-back studios of varying sizes as well as a number of communal areas and hospitality options across its four floors. |

|

| The Factory |

The Factory is a work and event space developed by Projekt in East London. Spanning 9,000 square metres across a 5.2-acre site, it has been designed to safeguard and grow the thriving artistic and cultural community surrounding the Royal Docks. |

| Grow Box and Custom Made | Seeking makers, bakers, cooks, creatives, artists, authors, workshop facilitators, or anyone with a special skill set to share with the community as part of a paid opportunity. |

|

Ideal for new start-ups and creatives |

We also recommend downloading the Flow app this is an app that has collaborated with local co-working space providers to bring you access to space on a pay-as-you-go model. |

See how Plant Lovers London and Suli Divine Hair & Beauty Spa were supported in their entrepreneurial journey having accessed information on projects, opportunities, affordable workspace, expert advice, and training.

Suli Divine Hair and Beauty Spa (PDF)

Market trading

Newham has a number of vibrant and diverse indoor and outdoor markets that sell a variety of goods. New traders are always welcome to apply and you do not need to have trading experience. We offer discounts for new traders.

To find out more information click here.

Discover Caxton Works

Caxton Works is the new independent hub of Canning Town located on Hoy Street. Alongside the 13 permanent units offering a range of fresh and exciting products and experiences there is now a New Community Street Market taking place every Sunday 11am - 6pm.

Our markets team has a time-limited offer for new traders who can secure a free trial followed by low ongoing running costs. If you would like to find out more please email with brief details of your products and services and they can discuss pitch availability and inform you of the next steps. Anyone taking up the offer will need to complete a formal market trader’s application form.

East Ham Marketplace

The Market Place is a striking indoor retail arcade featuring a water wall entrance from Myrtle Road. It offers visitors a place to eat, drink, and shop in the heart of East Ham, providing a modern indoor space that honours the history of the Market Hall.

Manor Park Meanwhile Space

The construction for Manor Park Meanwhile Space has been postponed under further notice.

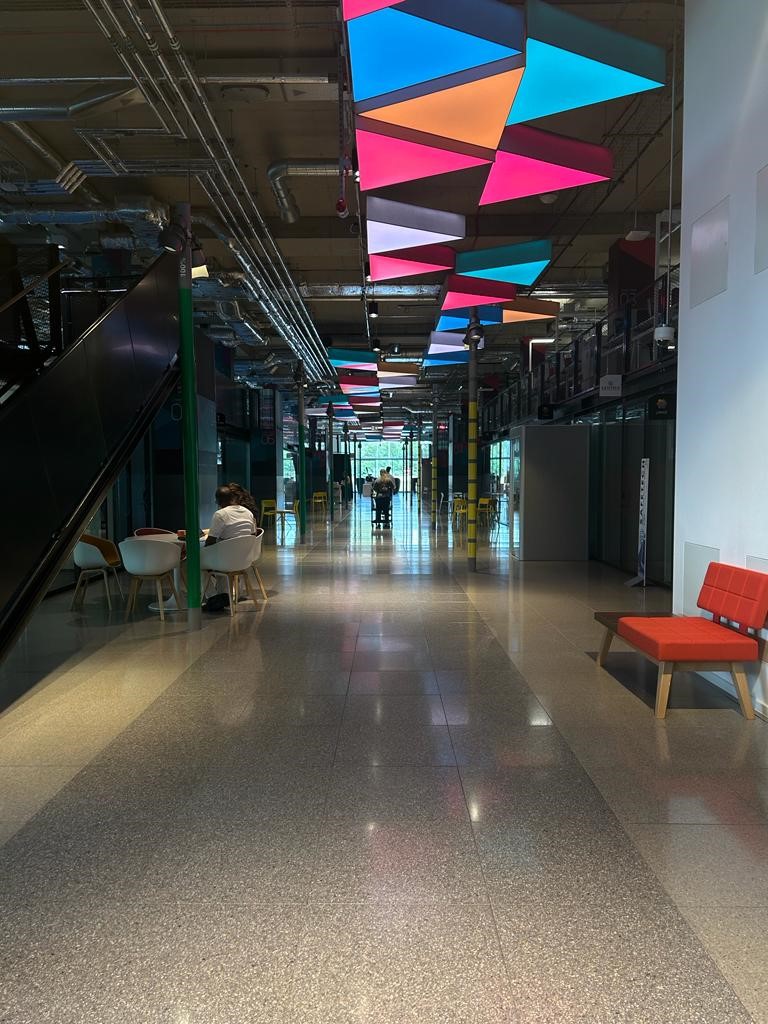

Plexal

View Plexals workspace brochure (PDF)

Rehearsal/ recording space

Use the Westfield venue to rehearse or record music!

Local musician looking for a place to rehearse? Or somewhere soundproof to record music? Come and use our space!

Events spaces for hire

We manage over 30 community centres. Some are managed directly; others are run by local volunteers and by committees of local people who are elected by members. This way the activities they offer reflect the needs and interests of local residents. The centres or the groups hiring the space manage the activities.

The community centres vary in size and in the facilities and services they offer. Most have halls to hire for meetings and private events such as weddings and parties. Other larger centres may also have meeting rooms or office space for hire.

|

E16, Royal Docks |

Various options available from flexible, multi-purpose event halls, state-of-the-art conference facilities to smaller meeting rooms. |

|

E20, Stratford |

Available for regular hire or one-off event. There are two rooms available depending on the type of event you would like to host. |

|

E15, Stratford |

Multi-purpose event space on the 4th floor to utilise for business related events. |

|

UEL Stratford and Becton |

Classroom and theatre rooms available for your next meeting or conference. We have secured 12% discount for businesses looking to book through us. Email us for further details. |