Becoming a London Living Wage Employer

News Update

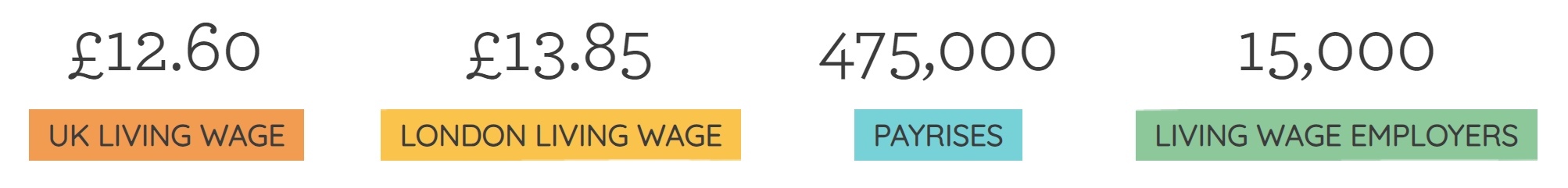

Real Living Wage Increases to £12.60 in UK and £13.85 in London

What is the real London Living Wage?

The real Living Wage is the only UK wage rate based on the cost of living. It is voluntarily paid by over 15,000 UK businesses who believe their staff deserve a wage which meets everyday needs.

Over 460,000 employees have received a pay rise as a result of the Living Wage campaign and we enjoy cross-party support. We have a broad range of employers accredited with the Foundation including half of the FTSE 100 and big household names including Nationwide, Google, LUSH, Everton FC and Chelsea FC, as well as thousands of SMEs.

The Living Wage rates for 2024-25 were announced on the 23rd October. Employers will then have 6 months to implement them by May 1st 2025.

Read more about real Living Wage

Benefits of paying the Living Wage

Paying a real Living Wage has many benefits to employers including:

- improving the employer brand

- boosting staff productivity

- motivation at work

- helps employers to remain competitive

- retain existing staff and attract new staff.

- Employers receive improved quality of applications for jobs

- It also helps organisations to secure contracts and funding

How to get accredited as Living Wage Employer?

Becoming a Living Wage Employer is very straightforward, the accreditation process requires a Licence Agreement to be signed between the employer and the Living Wage Foundation.

Living Wage News

Living Wage in Newham

Since becoming accredited as a London Living Wage Employer in March 2021, Newham has been leading the way to encourage other local businesses to pay the real Living Wage and make the Royal Docks a bastion of community wealth building and inclusive growth. Together with the Royal Docks Action Group, which was set up in June 2021, there are now 87 Living Wage Employers in the borough of which 31 are based in the Royal Docks.

Working on increasing awareness and uptake of the Living Wage and accreditation as a Living Wage Employer remains on top of Newham’s community wealth-building agenda. With thousands of job opportunities in digital skills and construction coming to the Royal Docks over the coming years, we will continue to work with the Royal Docks Action Group, local businesses and organisations to ensure these fantastic new job opportunities are paid at least the real Living Wage. They will provide new opportunities for local residents to improve their skills and access high-quality well-paid local employment.

Case Study: Enabled Living - First H&S Care organisation to be accredited in London (PDF)

Living Wage Event: Achieving Living Wage Accreditation

Newham leads the way at Living Wage Champions Awards 2023

How do I sign-up?

If you would like to find out more about becoming accredited or would like to sign-up, email us.